It has to be said that life insurance as a solution for inheritance tax planning is the place of last resort.

A lot of advisers fail to point that out owing to the fact that they get commission for selling life insurance and the fact that a lot of financial advisers lack the experience in the IHT market to actually solve the problem without re4esorting to life cover.

That said there is still a place for life cover but only, as I have said, as a last resort.

This site and all our advisers will aim to mitigate the majority of IHT liability but when all that can be done has been done there is still the option of just covering the liability left and that will then pay of the tax when due, ensuring that the estate remains intact for your beneficiaries.

There are essentially two types of life insurance policies associated with inheritance tax planning:

Policy type one – Gift inter Vivos

This policy is designed to cover the tax liability associated with PETs potentially exempt transfers (The 7 year rule). This policy is designed to reduce at exactly the same rate as the tax reduces after the PET has been made. So there is a 100% cover years 0 to 3, 80% year 3 to 4, 60% year 4 to 5, 40% year 5 to 6, and then 20% cover year 6 to 7.

The second and far more common type is standard life cover

Standard life insurance is ideally written on a whole of life basis but if cost is an issue you can take out a long term, term insurance plan. The only problem with the latter is the plan will finish at some point in the future and if that is before death you will not have any life insurance and no cover to repay the IHT bill on death. So you can see that the whole of life insurance plan is by far the best option.

When arranging any life insurance for IHT coverage you need to establish the level of the IHT liability and aim to have cover at that level. It is always worth considering indexing the sum assured to ensure the value of the cover rises with inflation as the likelihood in most cases the estate itself will also rise with inflation and in turn the IHT bill itself.

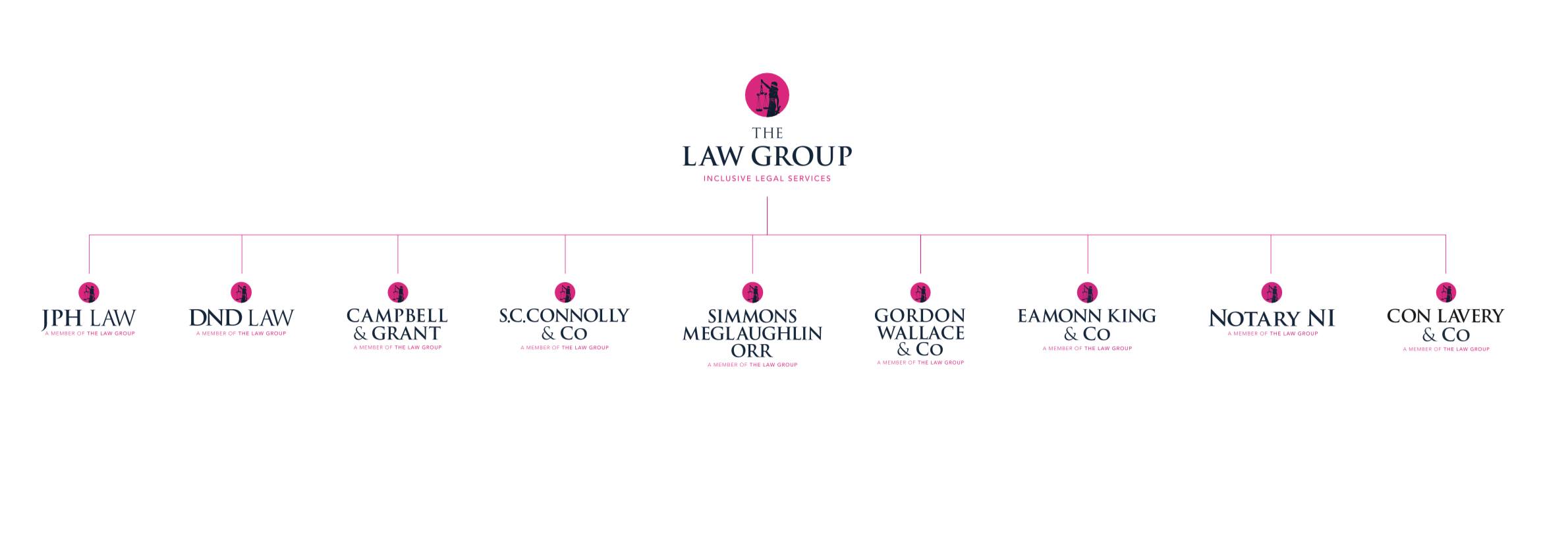

YOUR TEAM

Biography coming soon

Biography coming soon